Therefore, a company's assets are equal to its liabilities and its equity. The accounting equation is a founding principle in many accounting systems. In this way, the journal entries balance each other and uphold the accounting equation. Once the customer has paid the invoice, you can list a debit in the sales account and a credit in the accounts receivable account. You use the invoice to add a journal entry as a debit in the accounts receivable account and a credit in the sales account. For example, when a business sells a product or service to a customer, it generates an invoice to give to the customer. You balance journal entries with equal amounts of debit and credit. Large or small companies can benefit from using them.Īny company in any industry can use them. They help a business track its cash flow. They allow a company to manage its finances effectively. They reveal modifications made to the cost of goods sold, inventory and other accounts. They're the initial phase of recording and reporting a company's finances.Īuditors, investors and other financial professionals use them to review a company's finances.

There are several other benefits of journal entries, including: Journal entries allow you to track financial transactions to examine how each transaction affects the company. Journal entries for accounts receivable are important because they help analyze the performance of a company's finance. For instance, the receivables-to-sales ratio compares accounts receivable to sales during a certain period. Related: What Is Basic Accounting? Why is the journal entry for accounts receivable important?

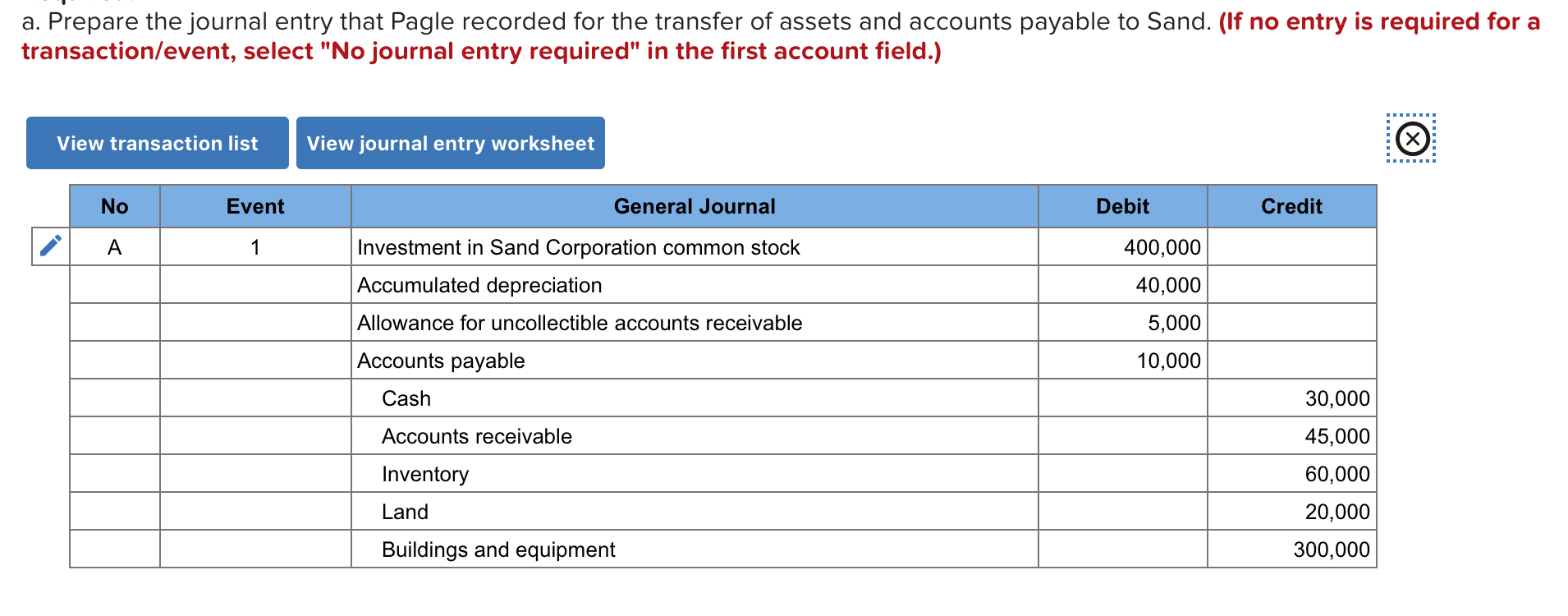

ACCOUNTS PAYABLE JOURNAL ENTRIES SOFTWARE

Because of this, these entries are beneficial in a double-entry accounting system.īecause of the complexity of a company's financial transactions, many companies use accounting software that drafts invoices and documents journal entries. You also list the total amount due from the invoice as a credit in the sales account. For the journal entry, you can document the total amount due from the invoice as a debit in the accounts receivable account. When you send an invoice to a customer, you enter it as a journal entry to the accounting journal. A journal entry may contain:Ī journal entry number or reference number for the entry Invoices include information regarding the sale of the products or services, such as a description of the product or service, the total cost and the payment due date. It stores this in a journal to keep the financial records organized, which is crucial to the successful management of the business.Ĭompanies use invoices to report accounts receivable transactions. What is a journal entry for accounts receivable?Ī journal entry for accounts receivable is a company's written report of every financial transaction.

ACCOUNTS PAYABLE JOURNAL ENTRIES HOW TO

In this article, we discuss what journal entries for accounts receivable are, why they're important and how to create a journal entry for accounts receivable. Understanding journal entries for accounts receivable can help you keep accurate and complete records for an organization and improve your financial qualifications. A company records these financial transactions through accounts receivable journal entries to help them track their finances more effectively.

Accounts receivable is the amount of money a customer owes a company in exchange for products or services.

0 kommentar(er)

0 kommentar(er)